How to Automate Billing for Subscription-Based Businesses

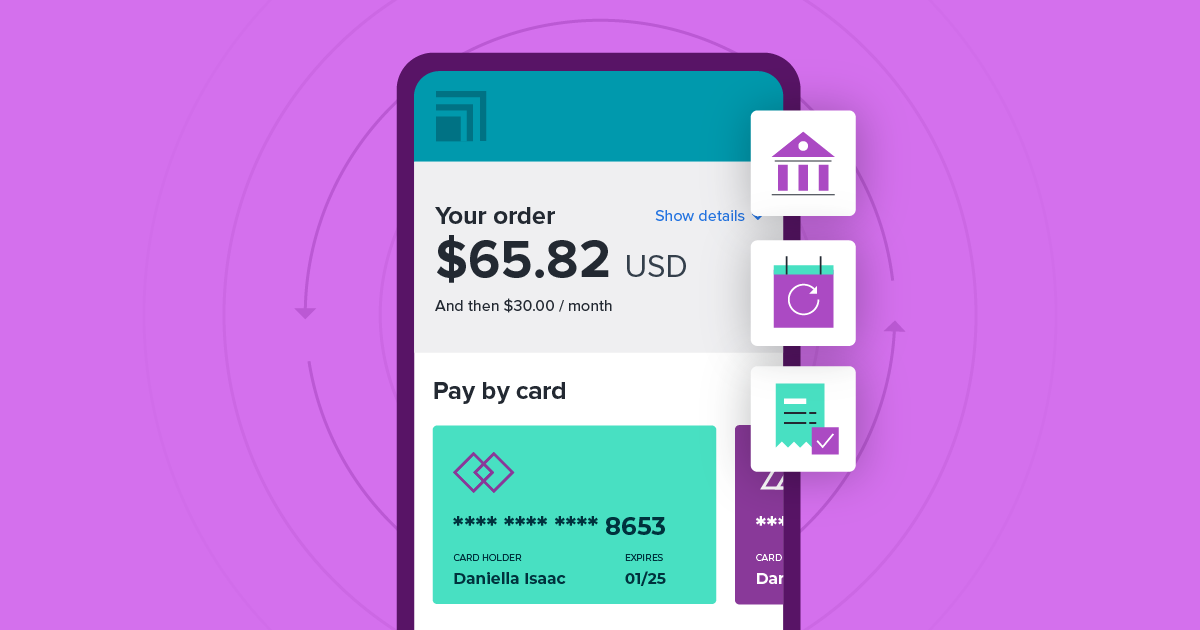

Especially when user numbers rise, managing payments for a subscription-based company can be challenging. Handling renewals, tracing lost payments, and guaranteeing a flawless subscriber experience define recurring billing. Using a dependable subscription payment system to automatically charge helps companies save time, lower mistakes, and boost cash flow. Here’s how companies could effectively automate their system for subscription payments.

Choose the Right Subscription Payment Processor

Choosing a subscription payment processor that allows recurring payments forms the basis of automated billing. The perfect processor should support several payment methods, manage several billing cycles, and fit your company model. Automation options for handling invoices, maintaining subscriptions, and processing payments free from human involvement come from providers such Stripe, Recurly, and Chargebee.

Set Up Flexible Billing Cycles

Giving flexibility helps to raise retention rates since not all consumers want the same billing plan. Good automation systems let companies create several billing cycles—monthly, quarterly, yearly, or bespoke periods. This guarantees that consumers can select a plan that fits their budget and degree of commitment, therefore increasing their likelihood of remaining subscribers.

Automate Payment Reminders and Invoicing

Managing rejected payments is one of the toughest problems with subscription billing. Automating invoicing and payment reminders helps stop forced turnover. Automated email alerts for forthcoming charges, rejected transactions, and past-due payments abound among many payment processors. Sending notifications ahead of time allows companies to encourage consumers to change their payment details, therefore preventing service interruptions.

Implement Smart Dunning Management

Dunning management is the processing of lost income and unsuccessful payment procedures. Built-in dunning capabilities of a subscription payment processor allow it to automatically retry unsuccessful transactions at ideal intervals. Certain sophisticated systems even employ machine learning to decide whether to retry charges, therefore optimizing the possibilities of a successful transaction. This helps to keep a consistent income flow and lowers turnover brought on by payment problems.

Enable Proration for Upgrades and Downgrades

In the middle of a billing cycle, customers could wish to change their plans; manually altering their rates can be difficult. Automating proration guarantees that clients are only charged for the time they use a service prior to either upgrading or downgrading. For the consumer as well as the company, a competent subscription payment system automatically computes prorated payments and assigns them to the following billing cycle, therefore facilitating a smooth change.

Monitor Key Metrics with Automated Reports

Improving subscription company performance calls for tracking income, churn rate, and payment success rates. Automated reporting capabilities available on most contemporary subscription billing systems give insights into consumer retention, revenue growth, and failed payment patterns. These studies enable companies to make data-driven decisions meant to maximize pricing, lower turnover, and increase general effectiveness.

Efficiency, scalability, and customer happiness all depend on a subscription-based company’s invoicing being automated. A strong subscription payment processor reduces unsuccessful transactions, improves financial operations, and simplifies ongoing payments. Businesses may maximize income growth and provide a flawless experience for customers by including automatic billing cycles, smart dunning management, and adaptable pricing modifications. Making wise tool investments guarantees long-term subscription economy success.